arizona charitable tax credit list 2021

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Charitable gifts and donations mortgage interest business expenses medical bills to the IRS.

Free Goodwill Donation Receipt Template Pdf Eforms

You must reduce your contribution amount by the total charitable contributions you made during January 1 2021 through December 31 2021 for which you are claiming an Arizona tax credit under Arizona law for the current tax year return or claimed on the prior tax year return.

. Taxpayers use a Schedule A to report itemized deductions eg. SAAF Condemns COVID-19 Mask-Wearing Comparison to HIVAIDS Prevention Strategies March 16 2021. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for.

519000 effective October 1. Before the official 2022 Massachusetts income tax rates are released provisional 2022 tax rates are based on Massachusetts 2021 income tax brackets. The annual tax deduction cannot exceed 2000 per beneficiary for single individuals and 4000 per beneficiary for married filing jointly.

With a 1098-T you may be eligible for an adjustment to income or tax credit. Enter this amount on 5C. Arizona has a state income tax that ranges between 259 and 45 which is administered by the Arizona Department of RevenueTaxFormFinder provides printable PDF copies of 96 current Arizona income tax forms.

Arizona Charitable Tax Credit SAAF Learn More. Qualified withdrawals are free from federal and Arizona income taxes. Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets.

The 2022 state personal income tax brackets are updated from the Colorado and Tax Foundation data. Once you list all of your itemized deductions you can calculate your total itemized deductions. Last week Arizona House Bill 2770 was passed allowing for business owners to determine whether masks are required in their places of business.

Colorado tax forms are sourced from the Colorado income tax forms page and are updated on a yearly basis. Use the 529 state tax deduction calculator to learn more.

Arizona Tax Credits Charitable Giving Tucson Phoenix Az

Arizona Tax Credit Hands Of Hope Giving Tucson Com

Arizona Tax Credits Charitable Giving Tucson Phoenix Az

Donate Casa Council Ronald Stephan Arizona

2021 Arizona Tax Credits Henry Horne

Az Tax Credit Donation David L Buterbaugh P C

Free Goodwill Donation Receipt Template Pdf Eforms

Arizona Tax Credit Scholarship

Arizona Tax Credits Charitable Giving Tucson Phoenix Az

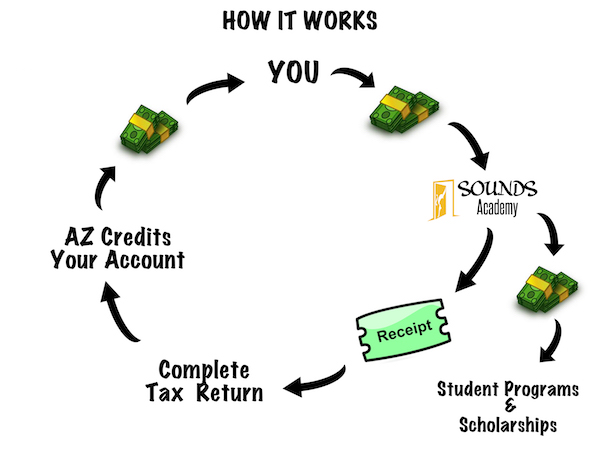

Qualifying Charitable Organization Sounds Academy

Arizona Tax Credit Scholarship

Free Goodwill Donation Receipt Template Pdf Eforms

Get Your Tax Credit Today The Society Of St Vincent De Paul

Arizona Tax Credit Scholarship

Donate Family Promise Of Greater Phoenix

3 11 3 Individual Income Tax Returns Internal Revenue Service